by GDI Insurance | Insurance

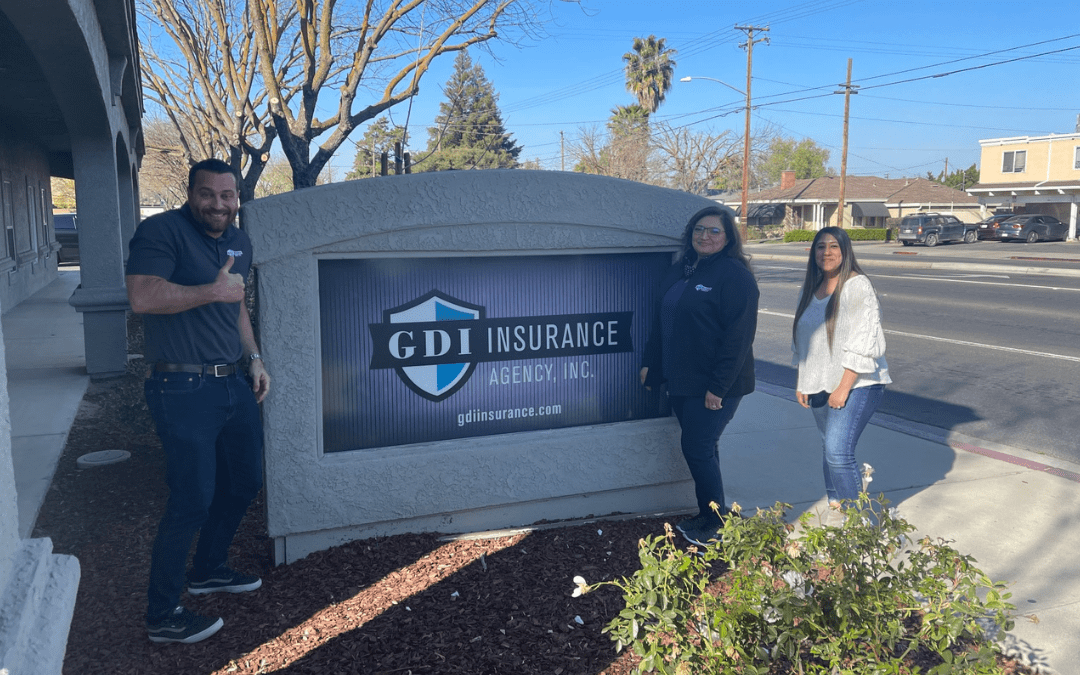

John Jackson Insurance Services joining GDI

Turlock, CA, Release Date: January 9, 2023. For Immediate Release

GDI Insurance Agency, Inc. (“GDI”) has announced today that John Jackson Insurance Services in Lincoln, CA will be joining GDI.

John Jackson specializes in the middle market space, specializing in complex and contract intensive clientele. John Jackson will bring to GDI experience and knowledge for our construction related clients, many strong insurance company relationships, and a wealth of expertise regarding contractual risk transfers.

“I have known John Jackson for more than 6 years now, and have the highest level of respect for him both as a professional Insurance Agent/Broker, and as an honest and forthright person. With the addition of John and his clientele, GDI’s construction and risk transfer analytical abilities and depth will be greatly increased. I’m proud to have him join our team.” Stated Matthew Davis, President of GDI.

John Jackson’s clients will continue to work with John, and will be provided additional services by GDI’s Core Commercial Team.

GDI, founded in 1989, is a leading provider of both Insurance and Risk Management services, consistently delivering unsurpassed programs to its clients. More information about GDI, GDI’s locations, and more can be found on the company’s website: http://www.gdiinsurance.com

Contact info:

Matthew Davis, MBA, CPCU, ARM, AAI

President

GDI Insurance Agency, Inc.

888-991-2929

by Matthew Davis MBA, CPCU, AAI | Insurance

That’s why we give our employees the time they deserve to be with the ones they love when it counts.

Our team works hard to make our company a success, and we want them to be able to give their families care and attention in return.

It’s why we provide benefits like:

Seven and a half to eight hour long work days so you can spend as much time with your family as you can

Seven and a half to eight hour long work days so you can spend as much time with your family as you can

Eleven to twelve paid holidays so you can spend each special day of the year with the ones you care about

Eleven to twelve paid holidays so you can spend each special day of the year with the ones you care about

Two weeks of paid time off in the first year of your employment so you’re there for you family when they need you the most

Two weeks of paid time off in the first year of your employment so you’re there for you family when they need you the most

These are just a few of the ways we take care of our team, and we want to extend the same benefit to you as we continue to grow.

That’s why we’re looking for new team members who are eager to serve, aren’t afraid to ask questions, and follow through on their getting our clients and staff the information they need when they need it.

Experience is important for these positions, but we’re really looking for the integrity and character that our new team members carry with them. So if you’re interested in applying, then click the button below to see how you can contact us and learn how to apply to join the GDI team!

We can’t wait to see how you’ll become an integral part of our amazing team!

by Matthew Davis MBA, CPCU, AAI | Insurance

Disregarding safety and compliance regulations has a very small effect on how your employees act their job.

That statement couldn’t be more false!

In reality, everyone in the workforce takes rules and regulations more seriously in their jobs when they work in an environment where they’re encouraged.

There is a statistical link between your team’s involvement in safety culture and the amount of hazards that occur on job sites.

Basically, if you involve your team in a more safety conscious culture, then they will pay more attention to safety on the job.

For you, that means you’ll be less liable, and your company’s insurance premiums will be lower as a result.

For them, that means that they can go home to their families without injury or worry.

It just goes to show, when you promote safety in the workplace, then you’re going to get safety in return.

If you want a free opinion or review of your safety experience or claims experience, then GDI is willing to help your company improve!

Click the link below to visit our website and contact us to set up your review, you won’t regret it!

by Matthew Davis MBA, CPCU, AAI | Insurance

They expect quality coverage of course, that’s just given, but shouldn’t your broker want to see your business thrive just as much as you do?

At GDI, we make it a point to educate ourselves consistently about how we can help our clients protect their businesses, especially with summer coming and all the danger it brings.

We pride ourselves on being able to give you the tools to best protect your business against possible threats, and with wildfires becoming more common over the years, we’re arming ourselves with the knowledge you need to keep your business safe.

Your preparedness is our job, and making you prepared means educating ourselves for what to come.

That’s why we can tell you to start:

Increasing your level of defense to potential fire losses by creating defensible space and by having on-site water.

Increasing your level of defense to potential fire losses by creating defensible space and by having on-site water.

Budgeting your family’s income to prepare for increased insurance premiums for the next three to five years.

Budgeting your family’s income to prepare for increased insurance premiums for the next three to five years.

Removing fuel from your commercial facilities to mitigate as much damage as you possibly can to your facilities.

Removing fuel from your commercial facilities to mitigate as much damage as you possibly can to your facilities.

Wildfires are a danger to everyone, and businesses could see their doom in the encroaching flames. That’s why we want to make sure you’re as covered as you can possibly be.

That’s why so many businesses trust GDI. We know that your business isn’t just your livelihood, it’s something you’ve cultivated and want to protect. We see our client’s success as an extension of our own, and we want to have your back as you grow.

We work with you to make sure that you’re getting exactly the kind of coverage and tools you need for your individual operations.

We’ll identify your areas of risk to make sure that you won’t be left behind. So, visit our website to learn more and get a free quote.

by Matthew Davis MBA, CPCU, AAI | Insurance

One of the biggest questions that insurance brokers are asked is how companies can get the lowest rates possible.

And before you ask, we’re no exception.

However, the truth of the matter is that simply paying the lowest cost for your coverage isn’t the best way to get lower rates overtime, and may actually result in you becoming more liable for incidents within your company.

Ultimately, that means your rates will only go up and you’ll be left asking the same question over and over again. Part of the process of lowering your overall rates can be time consuming and requires investment into your team, but it will result in lower rates for your company.

It’s been made clear time and again that if you invest into a happy and healthy team of employees that your team will want to give back to your company which will result in the lower rates you’re looking for.

So if you’re looking for lower rates, you need to ask yourself if you have the following:

✅ A human resources department to ensure your team is treated fairly and have plenty of opportunity to advance in the company

✅ Employee benefits to protect your team’s health and help them invest in their own futures through 401k and other systems

✅ OSHA compliance trainings and worker’s compensation plans to keep your team safe and ensure their proper recovery when they’re injured

By investing in programs that benefit your team you’ll be ensuring lower rates in the long run, which is something that we at GDI want for you too.

At GDI, we want to see every client that contacts us be able to thrive, and that means helping you and your company get the lowest rates you possibly can. We want to give you the advice and assistance you need to see your costs go down every single year.

That’s why we take the time to educate our clients about their current rates, why their rates are high or low, and what they can do to lower them.

We’ll work with you business to get you on track to lower rates and build a better business by following the steps.

You want to see your revenue at its best, and GDI wants to get you there.

Click the button below to get a free quote today, and put your business on track for lower rates with our help.

by Matthew Davis MBA, CPCU, AAI | Insurance

What kind of operations should you have in place to ensure you get lower rates?

It’s true that ensuring your employee’s health and safety will lower your rates overtime, but having certain internal operations in place will have the same effect.

But what kind of operations should you have in place that keep your company safe from liability and theft?

It’s time to start asking yourself if you have:

➡️ Liability insurance policies in place to ensure that your company is only responsible for its own operations and employees?

➡️ Cameras, GPS trackers, and other equipment in place if you have tools or other material that is liable to be stolen?

➡️ Sprinklers and alarm systems with your storage facilities and your offices to keep your building safe and adhere to the law?

Keeping your business and equipment safe from liability and theft will relieve your company of that very same liability.

The less your company is liable for theft and the injuries/mispractice of others, that means fewer claims on your company which will result in lower rates.

What kind of resources do you have in place to protect your equipment and work spaces?